"Winning Forex Trading Strategy - The Way To Make Big Money In Forex (Turning Poor Become Rich, Rich Become Richer)"

Friday, December 19, 2014

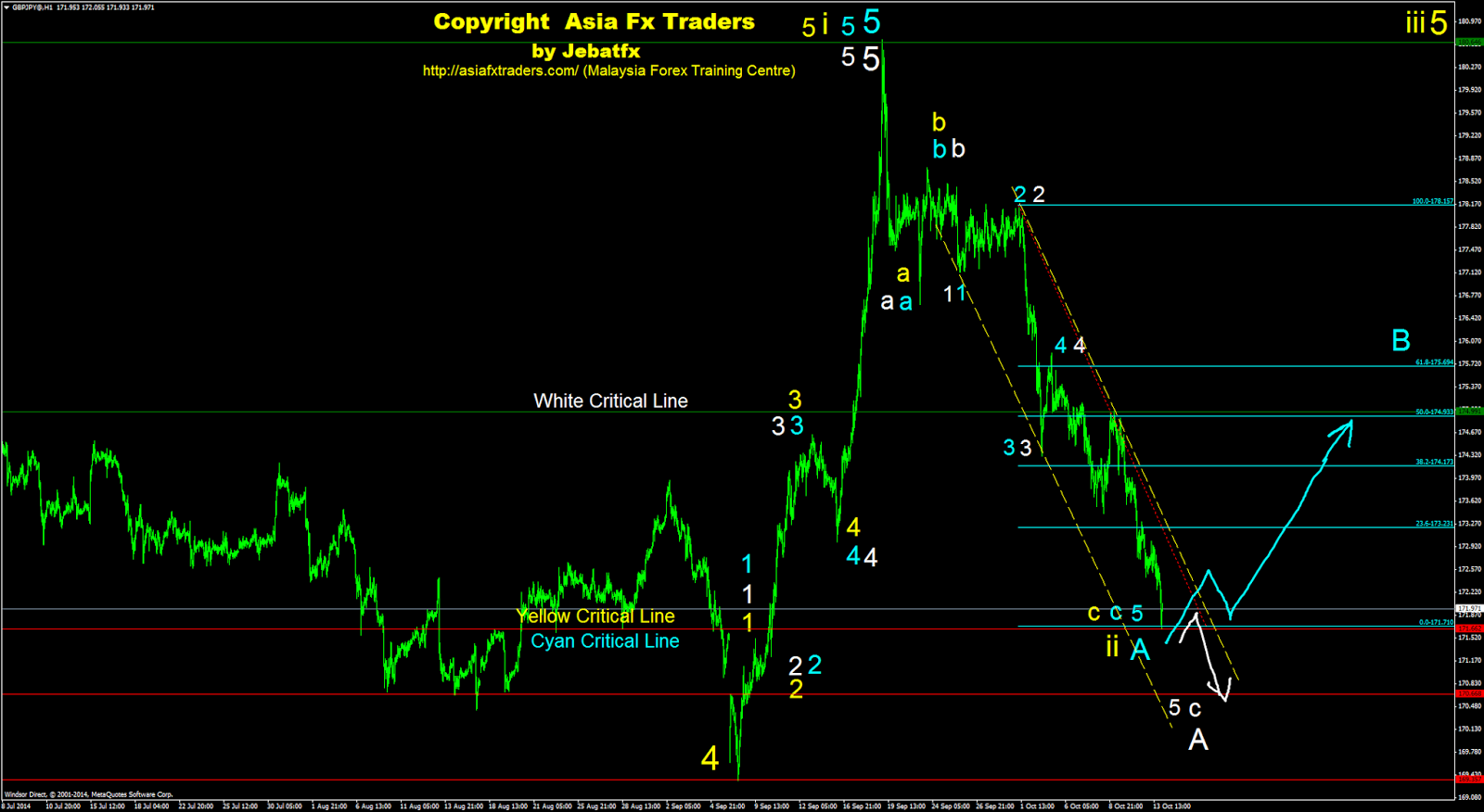

Gbp vs Jpy (1H)

Preferably, I believed market in progress to perform major wave 5 either in yellow or aqua. Please be extra careful that market also have a potential to complete a corrective wave b in white either at (FR61.8%) or a double top pattern. Good luck and happy weekend.

Wednesday, December 17, 2014

Gbp vs Jpy (1H)

At the moment, I am looking toward a potential of another bullish continuation trend scenario in yellow. A Bear Trap pattern would bolster to this scenario. Otherwise, we may see another bearish continuation trend scenario in white. Good luck.

Tuesday, December 16, 2014

Gbp vs Jpy (1H)

Favourably, I am expecting market to perform another bearish continuation trend scenario either to complete wave 4 in yellow or corrective wave c in white. Otherwise, we may see market bounce back to perform major wave 5 in aqua. Good luck.

Monday, December 15, 2014

Gbp vs Jpy (Daily)

At the moment, please be noted that market have a good potential to perform another bullish rally either to complete major wave 5 in yellow or aqua. Otherwise, I believed market in progress to perform a bearish reversal trend to complete corrective wave a,b and c in white. Good luck.

Thursday, December 11, 2014

Gbp vs Jpy (1H)

Preferably, I believed market in progress either to complete wave 4 in yellow or corrective wave c in white. A further breakout toward the bearish continuation critical line 1 and 2 would bolster to this scenario. Otherwise, we may see market to bounce back to perform wave 5 in aqua. Good luck.

Wednesday, December 10, 2014

Gbp vs Jpy (1H)

Preferably, I beleieved market in progress either to complete wave 5 in yellow or corrective wave b in white. A breakout towards the bullish continuation critical line 1 would bolster toward the alt count scenario in yellow, otherwise a pullback would bolster toward the alt count in white. Good luck.

Thursday, December 4, 2014

Gbp vs Jpy (1H)

Preferably, I am expecting market in progress to complete wave 3 in yellow before a potential of any bearish retracement trend scenario. Otherwise, market may start to falls down refering to the alt count in white or we will see another strong bull rally in aqua. Good luck.

Wednesday, December 3, 2014

Gbp vs Jpy (1H)

At the moment, I am looking forward for a potential or either a bearish retracement trend scenario either to complete wave 4 in yellow or corrective wave a in white. A good breakout towatd the lower yellow trend line would bolster to this scenario. Please be noted that market may perform a bull trap pattern. Otherwise, we may see another strong bullish rally to complete wave 5 in aqua. Good luck.

Friday, November 28, 2014

Gbp vs Jpy (1H)

At the moment, a valid "ascending triangle" would bolster towards a bullish continuation trend scenario to complete wave 5 either in yellow or aqua. Otherwise, market may break the lower yelllow trendline to perform corrective wave c in white. Good luck.

Wednesday, November 26, 2014

Gbp vs Jpy (1H)

At the moment, I am expecting either a bearish retracement trend scenario or a bearish reversal trend scenario. A breakout toward the lower red trendline would bolster to the alt counts either in aqua or white. Otherwise, we may see market to perform a bull trap in yellow before expecting any potential towards a downturn. Good luck.

Tuesday, November 25, 2014

Gbp vs Jpy (1H)

Preferably, I am looking forward for a "bull trap" diagonal triangle pattern to complete wave 5 in yellow before expecting any potential towards a bearish reversal trend scenario. Otherwise, market may falls to perform corrective wave c in white. Good luck.

Monday, November 24, 2014

Gbp vs Jpy (1H)

At the moment, as long the aqua/yellow critical line remain intact, I believe market will perform another bullish continuation trend scenario either to complete major wave 5 in yellow or aqua. Otherwise, we may see market to perform corrective wave a,b and c in white. Good luck.

Thursday, November 20, 2014

Gbp vs Jpy (Daily)

At the moment, since market already break the bullish continuation critical line 1, I believed market in progress to perform another bullish rally to complete major wave 5. Another strong rally would bolster towards the alt counts in aqua or white. Otherwise, market may start to perform a reversal pattern once 5 in yellow is completed. Good luck.

Tuesday, November 18, 2014

Gbp vs Jpy (1H)

Preferably, I am looking toward a potential of a bearish continuation trend scenario to perform subwave 3 refering to the alt count in white. A valid HnS pattern and a breakout to the aqua critical line would bolster to this scenario. Otherwise, I believe market will going up either to complete a "triple top" in yellow or wave 5 in aqua. Good luck.

Monday, November 17, 2014

Gbp vs Jpy (1H)

At the moment, as long the bearish continuation critica line 1 is remain intact, market have potential going further up either refering to the alt count in white or aqua. Otherwise, I am looking forward market to falls down refering to the alt count in yellow. Good luck.

Friday, November 14, 2014

Gbp vs Jpy (1H)

At the moment, a breakout to the bearish continuation criticla line 1 would bolster towards either refering to the alt count in white or yellow. Otherwise, market may going up again to complete wave 5 in aqua. Good luck and happy weekend.

Thursday, November 13, 2014

Gbp vs Jpy (1H)

Preferably, I believed market in progress either to complete wave 4 either refering to the alt count in aqua or yellpw before expecting for another bullish continuation trend scenario. Otherwise, we may see market to further going up to complete wave 5 in white. Good luck.

Wednesday, November 12, 2014

Gbp vs Jpy (1H)

At the moment, a pullback or a bull trap pattern would bolster either towards the alt count in yellow or white. Otherwise, we may see another strong bullish rally to complete wave 5 in aqua. Good luck.

Tuesday, November 11, 2014

Gbp vs Jpy (1H)

Favourably, I am looking forward for another bullish continuation trend scenario either tp complete a HnS corrective wave b in yellow or a double top before expecting a reversal trend. Otherwise, we may see another bearish retracement trend scenario to complete wave 4 in white. Good luck.

Monday, November 10, 2014

Gbp vs Jpy (1H)

At the moment, I am looking forward for a possibility of market to perform a "Head n Shoulder" pattern in yellow. Otherwise, we may see market further retrace to complete wave 4 in white or another bullish continuation trend scenario to complete wave 5 in aqua. Good luck.

Friday, November 7, 2014

Gbp vs Jpy (1H)

At the moment, I believed wave 3 was already completed and expecting market to perform a bearish retracement trend scenario to complete sub corrective wave a, b and c/4 either in white or yellow. Otherwise, please be careful for another bullish continuation trend scenario in aqua. Good luck and happy weekends.

Thursday, November 6, 2014

Gbp vs Jpy (1H)

At the moment, I am looking towards a potential of bearish retracement trend scenario to perform wave 4 either in white or yellow. Otherwise we may see another spike to complete wave 3 in aqua before a possible retracement. Good luck.

Tuesday, November 4, 2014

Gbp vs Jpy (1H)

Favourably, I am expecting toward a bearish retracement trend scenario to perform wave 4 either in white or yellow. Please be noted that market have potential to perform a truncated pattern in yellow. Otherwise we may see an extension of wave 3 in aqua. Good luck.

Monday, November 3, 2014

Gbp vs Jpy (Daily)

At the moment, I am expecting either a bearish retracement trend scenario in aqua or a "doible top" reversal pattern in yellow or white. Good luck.

Friday, October 31, 2014

Gbp vs Jpy (1H)

At the moment, I am expecting market to perform a bearish reversal trend scenario either in white or yellow. A pullback or bull trap pattern would bolster to this scenario. Otherwise, please be careful for another strong bullish rally to complete corrective wave B in aqua. Happy weekend and good luck.

Thursday, October 30, 2014

Gbp vs Jpy (1H)

At the moment, I am looking forward for an opportunity of a bearish reversal trend scenario either refering to the alt counts in white or yellow. A strong breakout toward the lower white trendline and critical line would bolster to the alt count in white. Otherwise, I am expecting a "bull trap" pattern in yellow before a potential of reversal trend. Good luck.

Wednesday, October 29, 2014

Gbp vs Jpy (1H)

Favourably, I am looking toward a potential of bearish reversal trend scenario in white. A valid "diagonal triangle" pattern, a "bull trap" scenario and follow by a breakout toward the lower white trendline would bolster to this scenario. Otherwise, I believed we may see another bullish rally to compplete either corrective wave B in yellow or aqua. Good luck

Tuesday, October 28, 2014

Gbp vs Jpy (1H)

At the moment, a breakout toward the lower red trendline would bolster to the alt count in white. Otherwise, I believed we may see another bullish continuation trend scenario to complete corrective wave B in yellow. Good luck.

Sunday, October 26, 2014

Gbp vs Jpy (1H)

Preferably, I am looking toward an opportunity of another bearish continuation trend scenario either refering to the alt counts in white or yellow. Otherwise, we may see another bullish rally to complete corrective wave B in aqua. Good luck.

Saturday, October 25, 2014

Friday, October 24, 2014

Gbp vs Jpy (1H)

At the moment, I believed market will further going up either to complete wave 4 in white or corrective wave B in yellow. Otherwise, market may break the lower red trendline and perform another bearish continuation trend scenario to complete wave 5 in aqua. Good luck.

Thursday, October 23, 2014

Gbp vs Jpy (1H)

A breakout toward the upper green trendline would bolster either refering to the "Bull Trap" scenario in white or another bullish continuation trend scenario in yellow. Otherwise, we may see another bearish rally to complete wave 5 in aqua. Good luck.

Wednesday, October 22, 2014

Gbp vs Jpy (1H)

At the moment, I am looking forward for a potential of another bullish contination trend scenario either in white or yellow before expecting market to falls back. Otherwise, I believed we may see another bearish continuation trend scenario in aqua. Good luck.

Tuesday, October 21, 2014

Gbp vs Jpy (1H)

At the moment, I believed market in progress either to complete subwave 4 (aqua or white) or corrective wave B before expecting another bearish rally. Please be extra careful since market potentially may go up further to complete subwave 4 in white or corrective wave B in yellow. Happy Deepavali and good luck.

Sunday, October 19, 2014

Gbp vs Jpy (1H)

Favourably, I am looking forward for another bullish continuation trend scenario to complete either wave 4 in aqua or corrective wave B in yellow. Otherwise, we may another bearish continuation trend scenario to perform wave 5 in white. Good luck.

Friday, October 17, 2014

Gbp vs Jpy (1H)

Preferably, I believed market in progress either to complete subcorrective wave 4 in white or corrective wave B in yellow before expecting toward another bearish continuation trend scenario. Otherwise, we may see another bullish rally to complete a double top of corrective wave B in aqua. Good luck.

Thursday, October 16, 2014

Gbp vs Jpy (1H)

At the moment, I am expecting towards a bullish retracement trend scenario either to perform subwave 4 in white or correcrive wave B in yellow @ aqua. This scenario is valid as long the aqua/yellow critical line remain intact. Please be careful toward any potential of a bear trap. Good luck.

Wednesday, October 15, 2014

Gbp vs Jpy (1H) & Daily

Gbp vs Jpy (Daily) - At the moment, I believed market in progress to perform a reversal trend scenario to complete corrective wave a. A strong bounce would indicate that market in progress to perform corrective wave b either in yellow or aqua. Otherwise, I believed we may see another strong bearish continuation trend scenario to complete corrective wave a in white.

Gbp vs Jpy (1H) - Favourably, I am looking toward a potential of a "double bottom" scenario to bolster towards completion of corrective wave A in yellow. A "bear trap" or strong bounce would support this scenario. Otherwise, I believed we may see another bearish continuation trend scenario to complete corrective wave A in white. Good luck.

Tuesday, October 14, 2014

Gbp vs Jpy (1H)

At the moment, I am looking forward for a potential of market reversal refering to the alt count in aqua. Otherwise, I believed we may see another weakening bearish continuation trend scenario in white before expecting a reversal. Good luck.

Sunday, October 12, 2014

Gbp vs Jpy (1H) & Daily

Gbp vs Jpy (Daily) - Favourably, a valid ascending triangle in yellow would bolster toward a bullish continuation trend scenario to perform another motive subwave iii, iv and v in yellow. Otheriwse, we may see a valid bull trap pattern to complete a reversal trend scenario to complete corrective a, b and c either refering to the alt count in white or aqua.

Gbp vs Jpy (1H) - Preferably, I am looking toward a potential of bullish continuation trend scenario either to perform subwave iii in yellow or corrective wave b in aqua. Otherwise, we may see another bearish continuation trend scenario to complete subwave 5 in white.

Friday, October 10, 2014

Gbp vs Jpy (1H)

At the moment, I am looking forward for another bullish continuation trend scenario refering to the alt count in yellow. A valid interted HnS pattern would bolster to this scenario. Otherwise, please be careful toward a potential of another strong bearish continuation trend scenario in white. Good luck.

Pada masa ini, saya mengharapkan pasaran akan naik semula merujuk kepada kiraan kuning. Pengesahan struktur "Inverted HnS" akan menyokong fenomena ini. Sebaliknya sila hati hati akan sebarang keberangkalian pasaran membuat jatuhan kuat merujuk kepada kiraan wave putih.

Thursday, October 9, 2014

Gbp vs Jpy (1H)

Hopefully, I am expecting market to go further up to complete wave 5 in yellow. But this scenario will be invalid if market further go down and break the yellow critical line. If this do happen, then I believe the market in progress to complete wave 5 either in cyan or white. Good luck.

Saya mengharapkan market akan terus naik untuk melengkapkan wave 5 dalam kuning. Tetapi keadaan ini akan menjadi tidak valid sekiranya market terus jatuh memotong garisan kritikal kuning. Jika ini berlaku, maka saya berpendapat pasaran akan terus jatuh untuk samada melengkapkan wave 5 dalam cyan ataupun putih. Hati hati.

Gbp vs Jpy (1H)

Preferably, I am looking forward for a bullish continuation trend scenario refering to the alt counts either in yellow or cyan. A breakout to the upper yellow trendline would bolster to this scenario. Otherwise, please be careful toward another bearish continuation trend scenario in white. Good luck.

Saya meramalkan market akan naik semula samada merujuk kepada kiraan wave kuning ataupun cyan. Keadaan pasaran naik yang seterusnya memotong garisan trend atas yg berwarna kuning akan menyokong lagi ramalan ini. Sebaliknya pasaran boleh membuat jatuhan yang kuat merujuk kepada kiraan putih. Hati hati.

Wednesday, October 8, 2014

Gbp vs Jpy (1H)

Favourably, I am looking forward market to going up to compete wave 5 in yellow. Otherwise, we may see another bearish continuation trend scenario to complete wave 5/C in cyan. Good luck.

Saya mengharapkan pasaran akan naik semula untuk melengkapkan wave 5 kuning. Sebaliknya jika ini tidak berlaku, maka pasaran akan terus jatuh untuk melengkapkan wave 5/C dalam cyan. Hati hati.

Tuesday, October 7, 2014

Gbp vs Jpy (1H)

Preferably, I am expecting marklet to perform of a "bear trap" scenario before making another bullish continuation trend to complete wave 5 in yellow. Otherwise, we may see another bearish continuation trend to complete wave 5 in cyan. Good luck.

Saya menjangkan pasaran akan membuat sedikit jatuhan sebelum naik semula untuk membuat wave 5 dalam kuning. Sebaliknya, pasaran boleh terus jatuh untuk membuat wave 5 dalam cyan. Hati hati.

Friday, October 3, 2014

Gbp vs Jpy (1H)

Looking forward for another bearish continuation trend scenario either to complete wave 4 in yellow or wave 5 in cyan. Good luck.

Merasakan pasaran akan terus jatuh samada untuk lengkapkan wave 4 (kuning) ataupun wave 5 (cyan). Hati hati.

Merasakan pasaran akan terus jatuh samada untuk lengkapkan wave 4 (kuning) ataupun wave 5 (cyan). Hati hati.

Subscribe to:

Comments (Atom)